That you don’t always need to be a person in the brand new military to visualize a great Va mortgage

Disadvantages out-of assumable mortgages:

- Having People: You must nevertheless make an application for the loan and you can satisfy their requirements, restricting your selection of lenders. You don’t have the blissful luxury from doing your research getting a lender because you will should be recognized to have, or take into regards to the existing mortgage.

- To own Customers: As stated before, in the event the merchant features good-sized domestic guarantee, you will likely need certainly to come up with the cash to have a significant downpayment, which is a financial complications.

- To possess Customers: In the event the a supplier is aware of the desirability of the house of the assumable home loan, this might boost need for the house and permit these to increase the cost, making the promote processes so much more competitive. While the a buyer, we should be mindful not to ever overpay into the house into the just reason for inheriting the borrowed funds. It is a good idea to calculate the fresh new monthly installments getting the homes considering observe how they examine.

Kind of Assumable Mortgage loans

To visualize a keen FHA financing, you ought to meet up with the simple FHA financing requirements, that can are and also make the very least down-payment from step 3.5 % and achieving a credit history with a minimum of 580.

You will need to observe that antique funds usually are maybe not assumable, except during the particular things, such as for instance immediately following passing or breakup.

How to Suppose home financing

Before incase home financing, you need to get recognition on the brand spanking new bank. This generally involves fulfilling a comparable standards once the getting an everyday home loan, including a being qualified credit rating and you may a reduced financial obligation-to-earnings ratio. Here are the standard procedures to follow along with:

- Prove Assumability: Make sure whether the mortgage try assumable and you can talk to the current home loan holder’s financial to be sure it allow assumption. You can also first want to get in touch with owner to get the contact details on brand new financial.

- Plan Will set you back: Learn the kept equilibrium on home loan and that means you can do brand new math with the cash try to give closing. If you feel the rest equilibrium will need more investment, begin looking around for lenders that promote that and discover the latest terms (note that this can vary on the most recent interest rates, as well as tends to be faster advantageous terms and conditions compared to financial your is just in case)

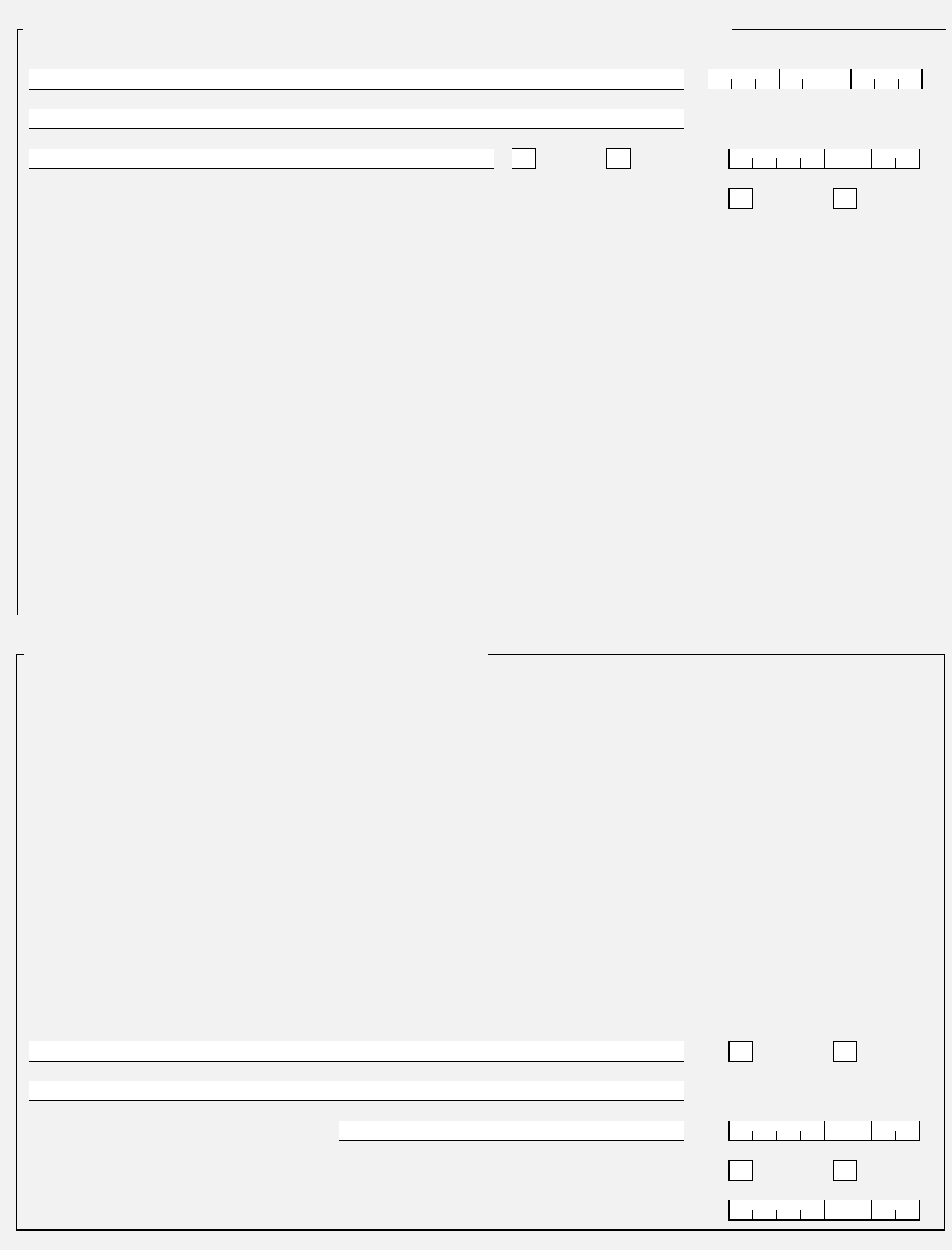

- Submit an application: Fill out an application, provide called for variations, and you may submit identification. The particular techniques may differ with respect to the financial.

- Personal and Sign Discharge of Accountability: Since assumption of one’s home loan could have been recognized, you’re handling the final stage of the procedure. Exactly like closing any other financial, you’ll want to finish the called for papers to be certain a softer changeover. One to very important document that often comes into play is the release off liability, hence serves to confirm your provider has stopped being in charge on the home loan.

In this phase, its crucial to absorb the details of your release of accountability. Make certain the necessary information are accurately documented, like the labels and make contact with information on both parties, the house or property target, the borrowed funds details, and just about every other pertinent recommendations. Evaluating the brand new document carefully may help prevent one misunderstandings or judge challenge later.

Remember, the brand new signing of your own release of accountability is short for an important changeover for both the buyer together with provider. They need loan under 500 credit score scratches when in the event that torch is passed, and the client assumes full duty with the mortgage. By finishing this action faithfully and you may thoughtfully, you may make a stronger base having a profitable and you will legitimately binding assumable home loan contract.