A mortgage is basically financing specifically designed with the objective of getting a residential property

When taking out a mortgage, a lender will give you the money you really need to purchase a property. In return, you invest in pay off the mortgage over an appartment period of your time – always fifteen to 30 years – plus desire.

Our home itself serves as collateral toward mortgage, which means that if you fail to make your home loan repayments, the lender can be foreclose towards home (put simply, take it right back) to recuperate their cash.

How does home financing work?

When a buyer enters a contract to order property however, never – otherwise refuses to – pay cash, a lender can give a mortgage to invest in the acquisition.

During the underwriting, the financial institution try guaranteeing some things. Basic, they wish to ensure the client was economically able to pay-off the mortgage. Next, they would like to make sure the worth of the home becoming bought was more than the borrowed funds matter. To do so, the lender have a tendency to see an appraisal of the home away from a professional 3rd-group appraiser.

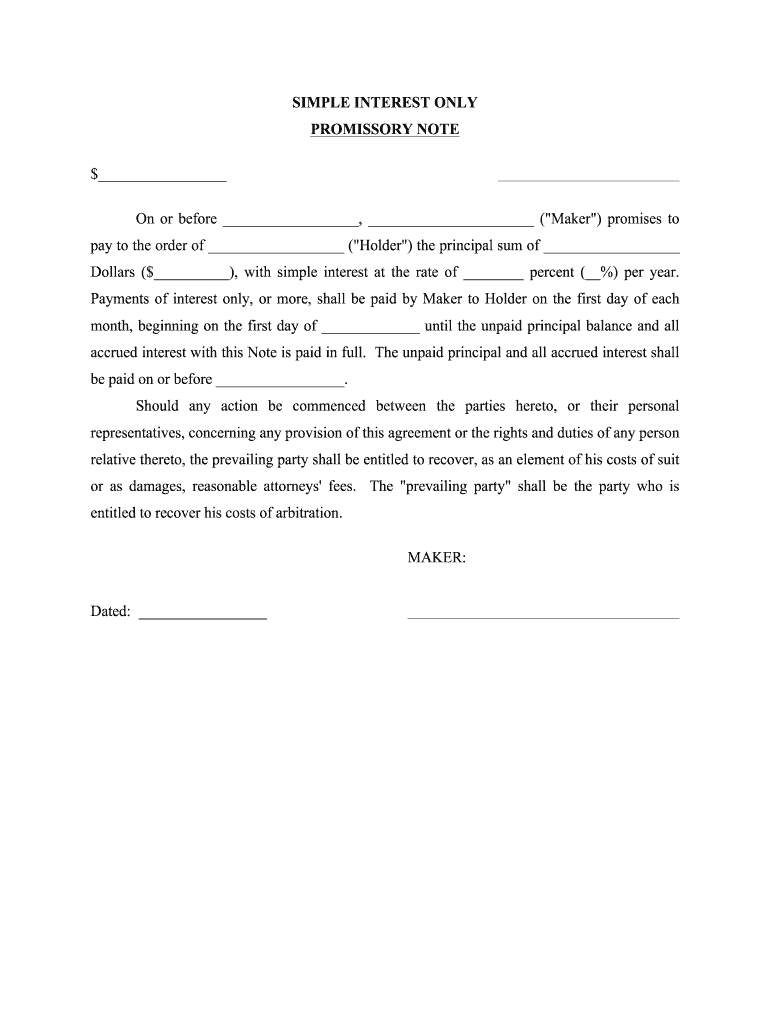

In the event the everything is under control, the financial institution approves the loan and informs the consumer he could be clear to close off. From the a home closure, the buyer signs a binding agreement, entitled home financing note, agreeing to help make the agreed upon monthly installments and you can taking the brand new bank’s to foreclose for the domestic once they do not pay.

The borrowed funds mention is actually registered which have an authorities workplace called a registry away from deeds. The mortgage notice places good lien on the home you to definitely affirms the newest lender’s courtroom need for the property until the home loan is repaid. Adopting the paperwork is finished, the lender transmits the brand new proceeds of your own financing on merchant together with transaction is done.

- Principal: The initial sum of money lent on bank.

- Interest: The price of credit that cash, shown once the an annual percentage rate (APR).

- Possessions fees: A yearly income tax comparable to a portion of your appraised value of your property.

- Homeowner’s insurance coverage: Insurance coverage up against flames, theft, storm damage and other risks on property.

- Individual mortgage insurance rates (PMI): Insurance rates to safeguard the lender should your worth of falls below the loan count. PMI is often needed when credit over 80% of residence’s appraised really worth.

A beginner’s self-help guide to mortgage loans

Will, mortgage lenders are tax and you will insurance rates wide variety regarding monthly mortgage fee. The financial institution accumulates these types of money on a monthly base and you can keeps the bucks into the an enthusiastic escrow until the tax and you will insurance rates costs is actually due. Loan providers do this while the, legitimately, they have the house before the home loan is actually paid down. In the event your homeowner’s insurance policies bill actually paid off additionally the home injury down, it is the financial who will endure ideal financial loss, perhaps not the brand new homeowner. The same thing goes if property taxation commonly repaid additionally the city is also foreclose towards house.

Since debtor repays the borrowed funds, they could – any time – pay extra amounts to minimize their balance. They are able to together with pay off the entire financial early with no punishment. Home owners may also should re-finance their mortgage if the https://availableloan.net/payday-loans-fl/ rates shed. Actually a 1% difference between the financial rate of interest accumulates so you can 10s out of thousands of dollars in the a lot more attract payments. To re-finance, the newest homeowner simply is applicable to possess a special home loan and you will spends the fresh continues of the financial to settle the old you to.

When a homeowner fundamentally takes care of the past mortgage into the a good property, the financial institution commonly document a release with the registry away from deeds one to launches the court interest in the house or property. The new citizen now owns their property 100 % free and you may clear.