Consumers which have sub-standard, if not poor credit, otherwise too-much financial obligation, refinancing can be risky

In such a case, the initial loan are repaid, enabling next loan to get written, in the place of merely making yet another mortgage and wasting the newest original mortgage.

Getting borrowers having a perfect Milford City loans credit score, refinancing would be the best way to convert a variable loan speed in order to a predetermined, and get a diminished rate of interest.

Commonly, just like the anyone function with their professions and you may continue steadily to create so much more currency they’re able to pay-all their expense punctually and therefore enhance their credit score.

Using this boost in credit appear the ability to procure fund at the down cost, which many people refinance through its banking institutions hence.

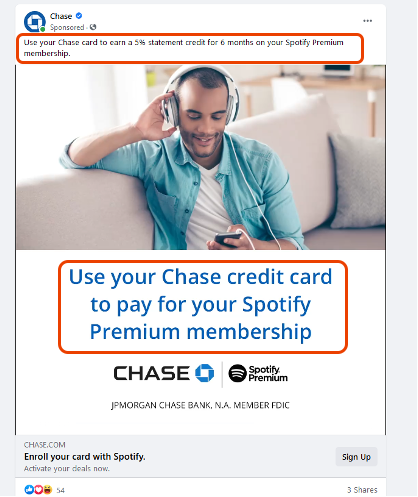

Pre-buy will cost you out of a home get because of home loan is also full right up in order to 29 per cent of the property’s really worth Picture Borrowing: Shutterstock

A lowered interest rate can have a powerful effect on month-to-month costs, possibly saving you countless dirhams a year.

A diminished interest have a deep effect on month-to-month money, probably helping you save countless dirhams a-year.

Without proper education, although not, it can in fact hurt that refinance, increasing your rate of interest as opposed to reducing it.

Cash out household security: Residents is also pull equity on the residential property. Should your security are extracted to cover household solutions or significant home improvements the eye expense can be tax deductible.

Alter mortgage course: Shorten duration to spend faster interest over the longevity of the fresh new financing and you can own the home downright quicker; prolong the cycle to lessen monthly installments.

Normally NRIs avail so it facility?

NRIs can also be refinance their loans-totally free characteristics inside Asia. In reality, the process for availing financing against a home does not differ much to own an enthusiastic NRI and a citizen regarding Asia.

As long as a keen NRI possesses a domestic or commercial property inside the otherwise their own title, that person can merely borrow secured on his assets.

The procedure for choosing a loan facing a house does not differ a lot to possess a keen NRI and a citizen out-of India.

However, there are limitations so you’re able to simply how much are going to be directed, availed otherwise borrowed, while having perquisites in regards to the minimal money requirements.

Limits whenever borrowing from the bank against financial obligation-free property for the Asia

Financing could only feel derived from a total of several characteristics, which happen to be susceptible to fees. Addititionally there is a constraint with the number which can be transmitted, that is around $250,000-a-people (Dh918,262) annually.

Minimal you can borrow secured on one possessions quite often, whether you’re a keen NRI or perhaps not, was INR five-hundred,000 (Dh 24,292), due to the fact restrict is INR 50 billion (Dh2.cuatro billion).

The borrowed funds matter can move up so you’re able to INR 100 mil (Dh4.nine mil), based on your own payment strength, and also the city the spot where the financing is paid.

Fund can simply feel derived from all in all, several services, which happen to be susceptible to taxation.

Extremely lenders typically offer funds anywhere between 60-70 per cent of your market price of your property (loan-to-value proportion) and is offered just normally so you can salaried NRIs.

Though some loan providers perform get 80 percent LTV, there are others giving only forty-fifty per cent LTV of your own house, that’s subject to your income qualifications.

LTV proportion was highest for loans removed facing land, while LTV ratio was reduced to possess mortgage facing commercial assets.

LTV also hinges on occupancy. Centered on research regarding Deal4loans, usually, new LTV proportion having a residential property that’s thinking-occupied, are 65 % of the market value.