Exactly what are the Great things about Private Mortgages?

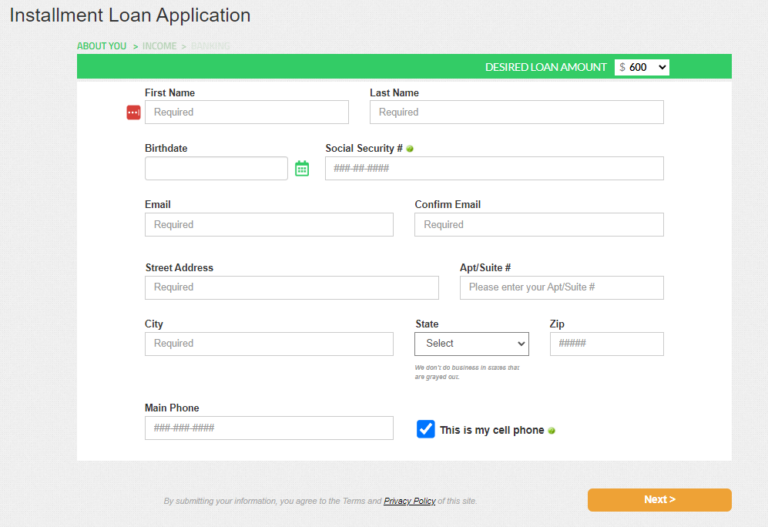

Once a potential debtor finds an exclusive bank that meets their demands, the next step is to try to get the mortgage. The program processes usually concerns submitting an application discussing the meant utilization of the money, the suggested installment package, and details about the property being funded. This can be markedly different from a timeless application for the loan, where appeal depends on the brand new borrower’s credit rating, money, and total economic wellness.

Following application, the non-public lender commonly evaluate the offer. It have a tendency to has an assessment of the house to determine its market value and you will possible success.

Private loan providers foot the mortgage behavior mainly towards property’s value additionally the borrower’s guarantee stake as opposed to the borrower’s creditworthiness. This advantage-founded strategy tends to make personal mortgages like attractive to home dealers and the ones with exclusive economic circumstances.

Abreast of approval, the mortgage words try decideded upon, and the loans are paid. As with any loan, it is necessary to see the terms of the mortgage completely, including the rate of interest, repayment agenda, and you may any potential penalties getting early repayment.

It is important to keep in mind that personal mortgages tend to have smaller words than conventional fund, normally ranging from that 5 years, and you will bring large rates. Brand new borrower constantly tends to make interest-only monthly premiums, with a beneficial balloon commission at the conclusion of the word that repays the main entirely.

Personal mortgage loans are generally shielded from the possessions by itself. It indicates in the event your borrower non-payments towards the mortgage, the lender has got the to just take ownership of the house thanks to a foreclosure process.

Really, private mortgages provide an adaptable and you will expedited replacement for conventional financing. Because they do feature increased pricing, capable render very important funding whenever rates and you can adaptability try important. Very carefully remark the money you owe, assets financing approach, and you may enough time-name objectives prior to choosing a private home mortgage.

Personal mortgage loans bring several collection of benefits to prospective individuals, specifically for those individuals in home financial investments or seeking to unique funding solutions.

step 1. Reduced Approval

Unlike conventional loan providers, private mortgage lenders commonly bring a quicker recognition processes. If you’re a classic mortgage usually takes days otherwise months so you can get approved, personal lenders will often give acceptance in 24 hours or less. This really is such useful when seeking to secure a property in an aggressive field or being forced to re-finance a preexisting home loan swiftly.

2. Versatile Terminology

A first benefit of private financing ‘s the independency during the mortgage terms and conditions. Individual lenders have significantly more liberty in order to make a loan that suits this new borrower’s particular requires, given aspects like the installment schedule plus the loan’s purpose. This liberty is very useful the real deal house traders seeking creative funding possibilities one a timeless bank may not give.

step three. No Credit history Requirement

Antique lenders essentially foot the mortgage choices heavily on the borrower’s credit rating. On the other hand, personal mortgage lenders have a tendency to desire personal loans in Vermont regarding the worth of the new a house getting financed and also the family collateral this new debtor keeps in the possessions.

This makes private mortgages a viable choice for those with below excellent borrowing from the bank or strange income supplies that may endeavor that have qualifying to own old-fashioned mortgage loans. People who find themselves mind-employed otherwise alive beyond your Us encounter one roadblock that have traditional mortgage loans seem to.

4. Accessibility Resource

Private mortgages provide use of large quantities of funding, particularly for a property buyers. Regardless if you are trying funds a residential property, industrial assets, otherwise house for invention, individual loan providers commonly normally fund sizable a home deals that may become outside of the scope away from conventional banking institutions.