Know Get across-Collateral Loan and just how it works

Securing fund usually concerns some actions and you will tool so you can make sure one another borrower and you may financial passions is actually safe. One tool ‘s the get across-equity loan, a comparatively decreased-identified but effective tool that may rather impact the borrowing from the bank and lending processes. This website delves with the exactly what mix-guarantee money try, the way they work, as well as their ramifications inside the Indian economic climate.

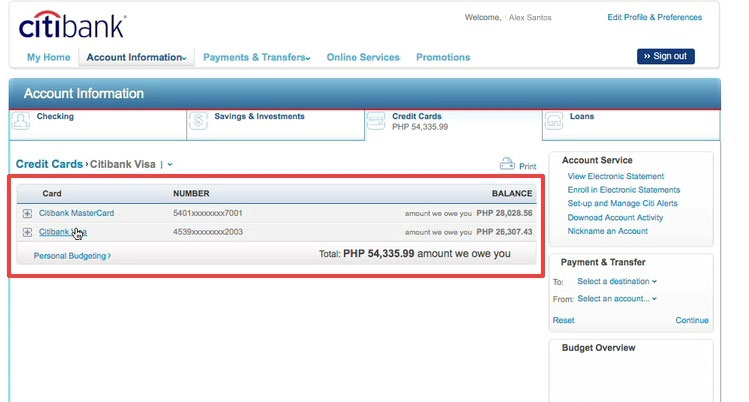

A combination-collateral financing is a type of mortgage arrangement in which you to otherwise a lot more property are used just like the equity to own several fund . This means that if the a borrower has numerous loans regarding the exact same financial, brand new security provided for one to mortgage can be used to secure a unique mortgage . Which interlinking away from possessions and financing can help borrowers power their assets more effectively if you are taking loan providers with shelter.

How Cross-Security Finance Functions

- Several Funds, Common Security :

For the a combination-security arrangement, a debtor ple, when the a borrower has actually a mortgage and you can a corporate financing with the same bank, the home mortgaged on home loan may also be used because the security towards company mortgage.

- Judge Agreement :

So it plan is formal thanks to a legal arrangement you to definitely determine brand new assets on it plus the financing they safe. The newest arrangement implies that the financial institution have a state toward equity the finance, not only the key financing.

- Enhanced Defense getting Loan providers :

In the lender’s perspective, cross-equity loans offer improved cover. In the event the debtor non-payments on a single loan, the financial institution is also get well the fresh new fees from the equity protecting people of money. This reduces the lender’s risk and will either result in even more beneficial mortgage terms to your borrower.

- Efficient Accessibility Assets :

Individuals is also control its possessions more efficiently. Instead of taking independent equity for every single loan, an individual advantage can be back several financing, which makes it easier to handle and potentially allowing for highest credit restrictions.

Cross-Collateral Loans within the Asia

When you look at the India, cross-guarantee fund are used in numerous contexts, especially in sectors such as farming, home, and you may providers funding. Knowing the applying of this type of finance about Indian context means a review of certain situations and you will regulations.

- Farming Loans :

Producers normally have multiple farming money for several intentions, like pick design, gadgets buy, and you may land invention. Cross-security plans allow them to have fun with its house as security getting a few of these loans, going for better usage of credit.

- Providers Funding :

Smaller than average average organizations (SMEs) seem to fool around with mix-collateral fund so you can safer multiple credit lines. For example, an SME can use the equipments and you may products because the collateral having one another working-capital money and you can expansion money. This can improve its funding demands and reduce the fresh administrative load out of dealing with several collaterals.

- A home :

On the a property field, designers might use an item of possessions since equity a variety of loans you’ll need for different phase regarding a job. Which assures continuing investment and you will mitigates the risk of financing shortfalls.

Benefits associated with Cross-Equity Fund

- Increased Borrowing Potential :

With the exact same asset so you’re able to safe numerous loans, consumers can potentially accessibility huge levels of borrowing from the bank. This is such as beneficial for enterprises looking to expand otherwise individuals investing in highest-scale systems.

- Basic Equity Government :

Managing that otherwise a number of property since the security to possess numerous funds simplifies this new administrative processes for borrowers. They decreases the must bring and you can monitor multiple https://www.paydayloancolorado.net collaterals.

That have improved protection, lenders can offer most useful interest levels and you can words. The low exposure on the bank normally lead to economy with the borrower.

Risks and you may Considerations

That significant chance are overleveraging. Consumers might end up protecting more borrowing from the bank than they may be able would, resulting in possible economic filters and higher standard exposure.

If a debtor defaults, the entire process of foreclosures could become advanced. The financial institution should browse the newest legal issues out of claiming the newest guarantee, which can be linked with several financing.

Defaulting into some of the mix-collateralized funds is also negatively affect the borrower’s credit history , since standard is related to all the loans covered by the fresh security.

Regulatory Structure for the India

The fresh Set-aside Lender off India (RBI) manages the newest techniques doing financing collateralization to ensure fair techniques and you can financial stability. Secret laws and regulations were:

This new RBI mandates that banking institutions categorize assets and you will conditions to have potential loss. Including advice precisely how mix-collateralized finance might be advertised and you may treated.

Financial institutions have to apply sturdy exposure administration methods to keep track of and you may decrease dangers with the mix-equity funds. This may involve regular assessments of the worth and you will standing of your own collateral.

Cross-security money is a robust financial device which can offer extreme positive points to one another individuals and you may lenders for the India. By allowing multiple funds as safeguarded by the same guarantee, this type of agreements bring improved borrowing skill, simplified collateral government, and possibly better loan words.

What is actually a combination-Security Loan?

A corner-Guarantee Mortgage is a kind of loan safeguarded by over that asset otherwise guarantee. It permits lenders to use several possessions to secure one loan, cutting chance.

How come a mix-Equity Mortgage work?

Inside a corner-Guarantee Loan, possessions such as assets, automobile, or opportunities are pooled to one another due to the fact collateral. If a person asset’s well worth drops short, others protection the mortgage.

Why like a combination-Collateral Financing?

Borrowers which have diverse assets or shortage of private collateral may benefit out of Cross-Guarantee Funds, because they can safer big amounts or most useful terminology.

Exactly what are the risks of Cross-Equity Loans?

Cross-Security Fund raise chance if a person investment refuses when you look at the worth, probably impacting the complete mortgage portfolio. Individuals can get deal with demands being able to access individual assets utilized while the collateral.